Finance leaders have come a long way from being bookkeepers and number crunchers; they’re now becoming guardians of data and proponents of digital transformation. As more businesses move away from reliance on manual processes and toward digitalization, department leaders are looking to financial process automation. This will give their teams the bandwidth and resources they need to move their organizations forward – leaving old preconceived notions (and their ledgers) in the past.

The Efficiency Imperative for Finance and Credit Teams

Automation is rapidly becoming a lynchpin for improving business performance in finance, where reducing cost and managing risk come with high expectations. Successful automation efforts will allow finance departments to add value in their roles, unleashing the potential to spend less time on administrative tasks and more time on strategy. Simply put, finance teams will fall behind if they do not embrace automation.

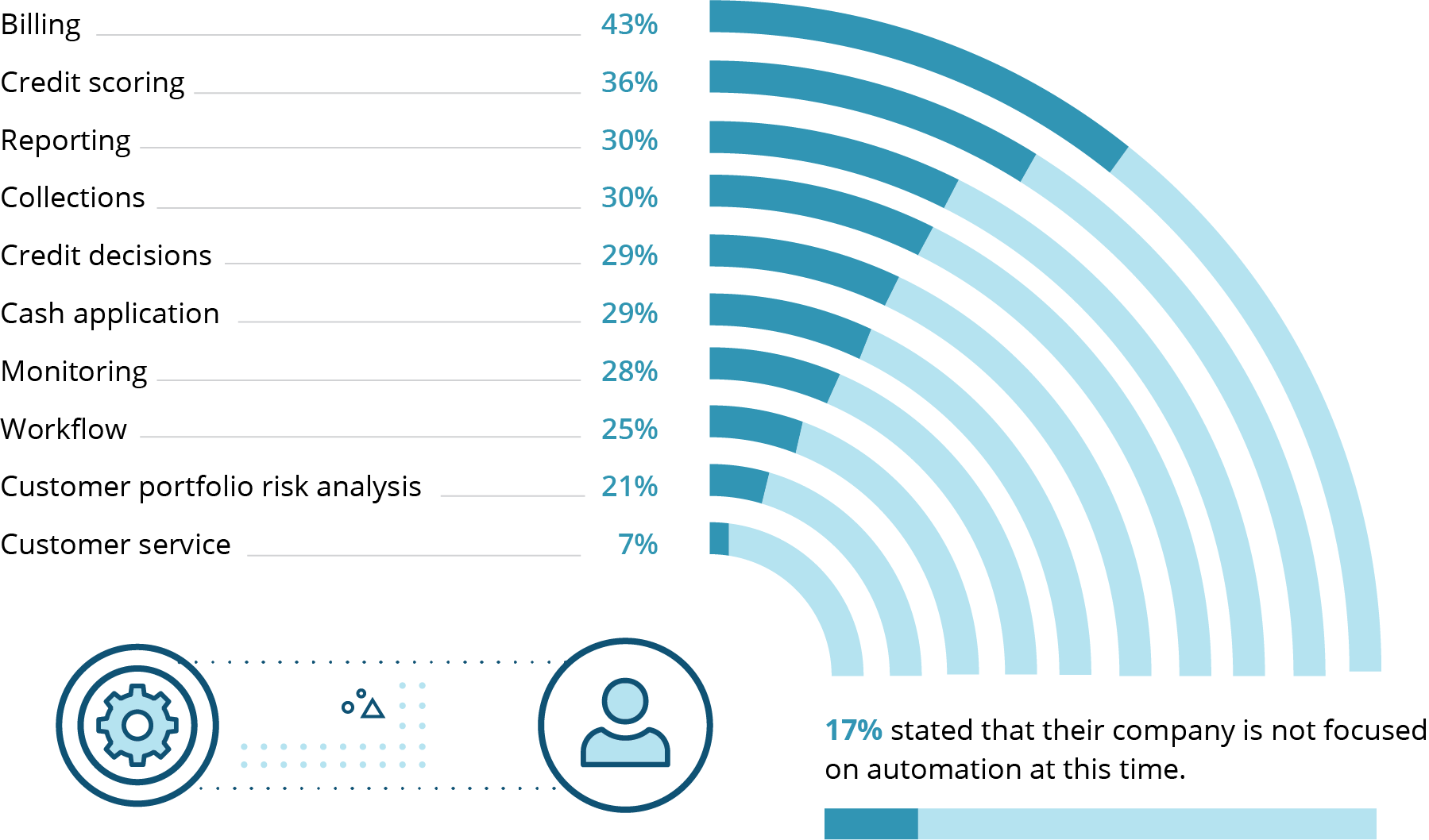

Dun & Bradstreet commissioned a survey of finance and credit leaders to understand how their organizations are using automation today, and what the opportunities and barriers are. This study found that 87% of surveyed finance leaders believe automation will improve the function’s efficiency in the next three years, giving employees more time for value-added tasks. But most organizations aren’t leveraging automation to the fullest today. While 83% of finance teams are automating at least one part of their processes, most (62%) are automating less than one-fourth of their process

Automation Benefits

While 83% of finance teams are automating at least one part of their processes, most (62%) are only automating between 0-25% of their processes. One in five respondents reported that between 26 to 50% of their finance and credit process are automated today. Only 11% reported that more than half of their processes are automated.

When fueled by analytics and insight, automation can reduce operational costs, increase efficiency, and help open new avenues of growth for finance teams by scaling and pulling in data from multiple sources at once. Organizations driven by data and insights are 39% more likely to report year-over-year revenue growth of 15% or more. For finance leaders in particular, automation must go beyond a “good idea” and become a strategic methodology to ignite the true potential of human, data, and machine.

CIAL 360 Credit: your gateway to automating credit decisions and driving growth

Our smart and intuitive platform transforms your credit assessment and risk management processes allowing you to grant suitable credit terms to every customer in your portfolio.

Speed up the sales cycle: Perform an automated digital assessment configured with your credit policies and values:

Forward looking organizations that have learned to effectively organize, manage, analyze, and activate their data through analytically inspired automation achieve the following benefits:

Manage risk

Decrease bad debt, optimize cash flow, reduce exposure to high-risk accounts, and minimize fraud.

Accelerate revenue

Prioritize relationships with the best customers, fueled by analytically driven decisions delivered via automation.

Reduce cost

Optimize resources with automation to reduce costs such as selling to, collecting from, and extending credit to customers.

Transform business

Accelerate digital transformation, created a trusted view of key relationships, unify data across departments, and leverage data for innovation.